Key Takeaways

- Increased focus on value-added products and strategic market positioning is expected to drive revenue and earnings growth.

- Strong distribution network and stable milk prices are anticipated to boost revenue and positively impact net margins.

- Rising costs and price pressures could squeeze Heritage Foods’ margins and profitability, with risks in new market expansion and reliance on consumer trends.

Catalysts

About Heritage Foods

- Heritage Foods Limited procures and processes milk and milk products in India.

What are the underlying business or industry changes driving this perspective?

- Heritage Foods is increasing its focus on value-added products (VAPs), which now contribute to 28% of total revenue. This segment is expected to grow further due to product launches and marketing campaigns, contributing to revenue growth.

- The Indian dairy market is anticipated to grow significantly with a 9% CAGR, and the VAP segment is expected to grow at over 20% annually. Heritage Foods is well-positioned to capture market share, which should positively impact revenue and earnings.

- The company has a strong distribution network with 7,200 distributors and 180,000 retail outlets, and it is expanding its reach in modern retail and e-commerce platforms. This increased distribution is expected to boost revenue.

- Heritage Foods has managed to secure milk procurement at a lower average price than the previous year and expects milk prices to remain stable, positively affecting net margins and earnings.

- Heritage Foods’ strategic expansion into new geographic markets and the enhancement of its product portfolio, particularly in high-margin segments such as cheese and paneer, is likely to support improved future net margins and earnings.

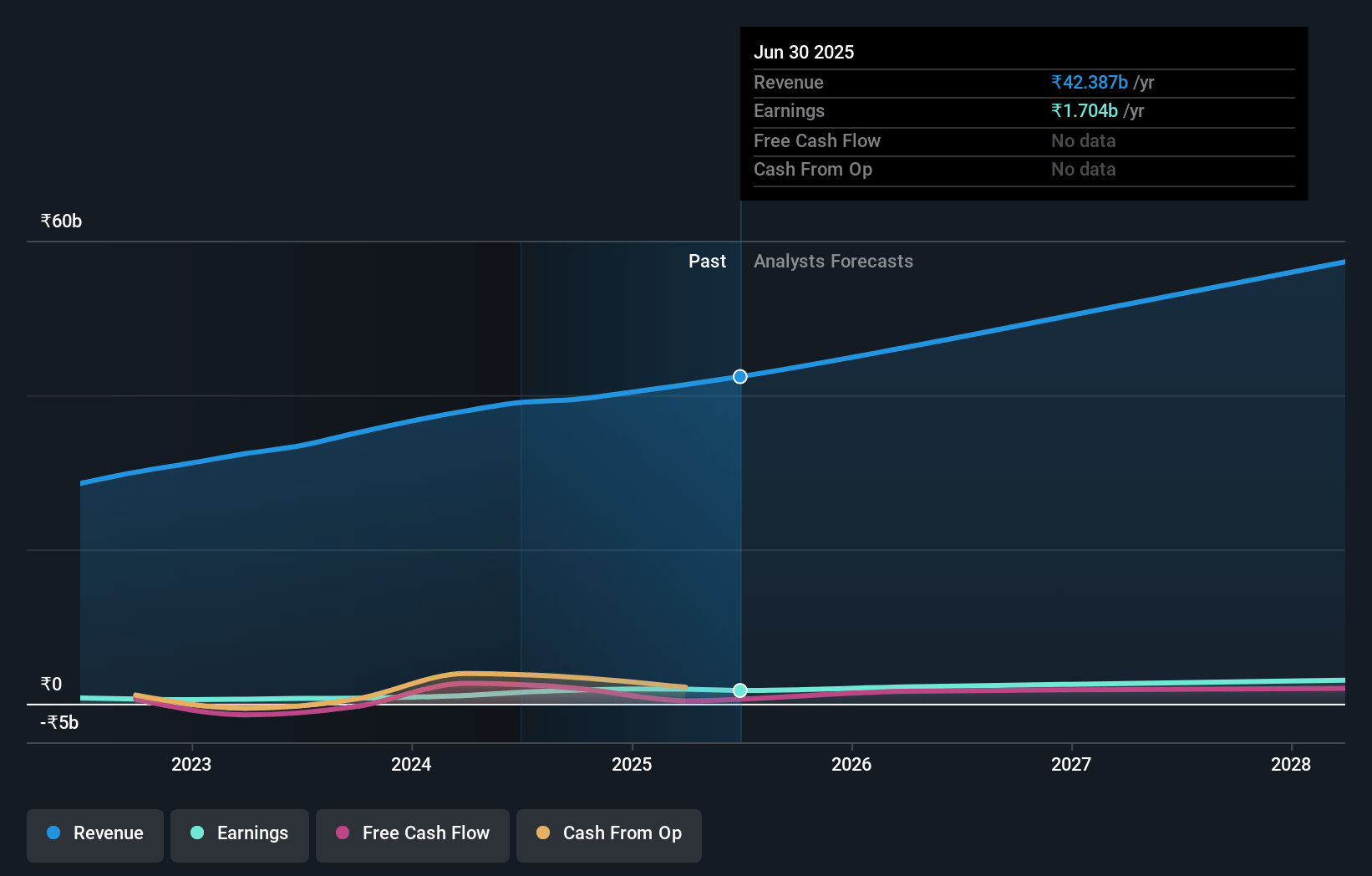

Heritage Foods Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?

- Analysts are assuming Heritage Foods’s revenue will grow by 13.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.7% today to 5.0% in 3 years time.

- Analysts expect earnings to reach ₹2.9 billion (and earnings per share of ₹31.18) by about February 2028, up from ₹1.9 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as ₹2.3 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 27.3x on those 2028 earnings, up from 20.5x today. This future PE is greater than the current PE for the IN Food industry at 22.4x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today’s terms, we will use a discount rate of 12.15%, as per the Simply Wall St company report.

Heritage Foods Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?

- Heritage Foods is facing firming up of milk procurement prices, expected to rise by ₹1.5 to ₹2, which could squeeze margins if not passed on to consumers effectively. This risk impacts net margins and profitability.

- The increase in fuel and other input costs, while average selling price of their products remains flat, can reduce operating margins if these costs continue to rise without corresponding price adjustments. This affects overall earnings.

- Although revenue from operations grew by 10%, the growth in other expenses by 24.81% year-on-year, possibly due to increased distribution and marketing costs, can pressure net margins if not managed efficiently.

- The company’s high exposure to value-added products, though beneficial, could result in dependence on continuous consumer adoption, risking revenue growth if consumer preferences shift or economic conditions tighten.

- Regional expansion into newer and non-core markets carries risks of underperformance compared to established markets, potentially affecting revenue targets and operational performance if these markets do not scale as planned.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The analysts have a consensus price target of ₹609.75 for Heritage Foods based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹724.0, and the most bearish reporting a price target of just ₹510.0.

- In order for you to agree with the analyst’s consensus, you’d need to believe that by 2028, revenues will be ₹58.4 billion, earnings will come to ₹2.9 billion, and it would be trading on a PE ratio of 27.3x, assuming you use a discount rate of 12.2%.

- Given the current share price of ₹421.4, the analyst price target of ₹609.75 is 30.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Source : DAirynews7x7 Feb 11th 2025 Simply Wall st