With solid domestic and international performance, a new Maharashtra plant, and enhanced distribution channels, Dodla expects continued revenue and margin growth in FY26.

Highlights:

- Revenue growth remains strong

- Expect improvement in margins

- Strategic expansion in Maharashtra through greenfield plant

- VAP sales to improve in Q4FY25

Dodla Dairy Ltd (DDL; CMP: Rs 1,149; Market cap: Rs 6,985 crore; Rating: Overweight), a key player in south India’s dairy sector, has reported strong results for Q3FY25.Although Q3 tends to be moderate for the dairy industry, Dodla’s ability to maintain double-digit revenue growth is a testament to the strength of its diversified portfolio and strategic initiatives.

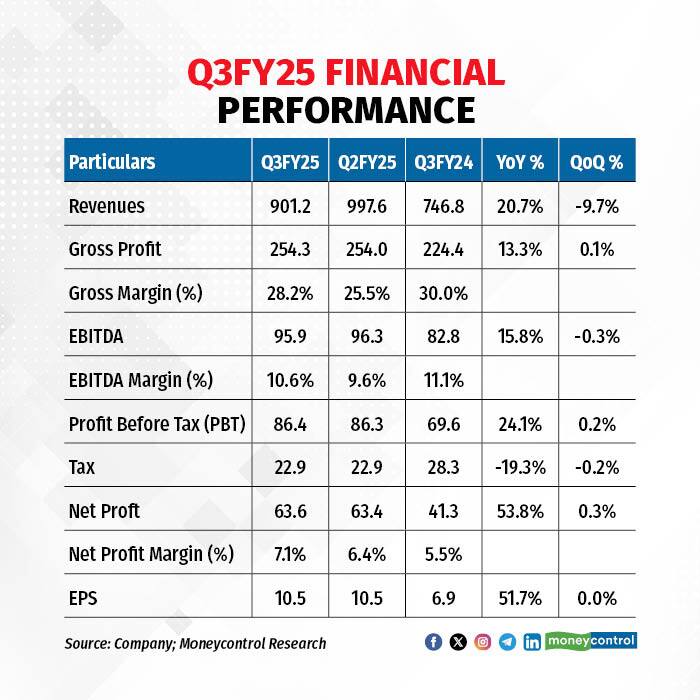

Strong financial performance

Revenues grew 20.7 percent year on year (YoY) to Rs 901.2 crore and was driven by higher volumes and a healthy festive demand. Domestic business grew by 14.5 percent YoY to Rs 802.6 crore, whereas international business saw a phenomenal YoY growth of 114 percent and registered revenues of Rs 98.5 crore in Q3FY25.

Indian dairy operations were well complemented by the performance of Africa and Orgafeed businesses, both of which delivered healthy growth rates on the back of higher capacity utilisation levels.

The Kenya and Uganda markets are performing well, with Dodla gradually ramping up plant capacities. The Kenya plant currently operates at 40 percent capacity, leaving significant room for growth, while Uganda has shown a steady volume growth, positioning Dodla to capitalise on the expanding demand in Africa.

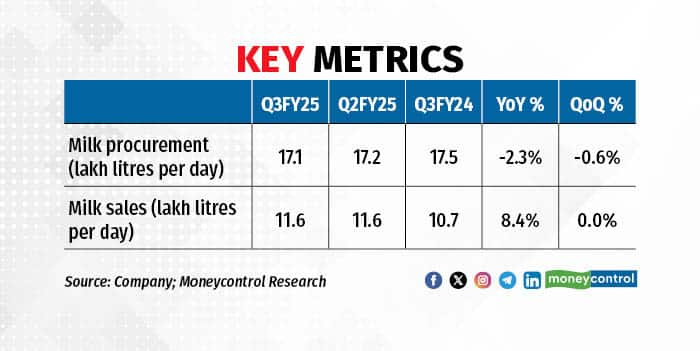

Milk procurement prices increased due to lean season dynamics, impacting gross margin for the quarter. However, the company maintained adequate inventory levels to address rising procurement costs and ensure supply chain stability.

EBITDA margin stood at 10.6 percent, slightly lower than the 11.1 percent from the previous year. This was mainly due to higher employee costs, driven by annual increments and staff addition at the Kenya plant.

In terms of pricing, the company has maintained its selling prices in Q3FY25 but plans to increase milk prices to account for the rising procurement costs. This price hike is in line with industry trends and is expected to offset cost increases without disrupting the market.

Milk prices are expected to continue their upward trend, with a further hike of Rs 1- 2 by March or April, as per management commentary. This price increase is in line with the broader industry trends, with competitors also adjusting prices to account for inflationary pressures at the farmer’s level.

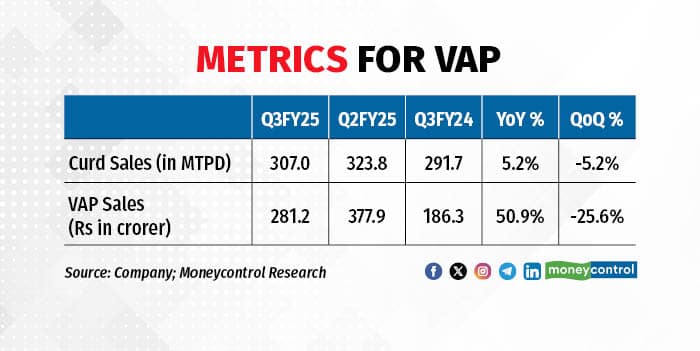

Seasonal impact on VAP sales

VAP (value-added product) sales have contributed 31.2 percent to revenues in Q3FY25. However, sales were softer than anticipated due to seasonal factors affecting demand for products like curd, flavoured milk and ice cream. With summer season approaching, DDL expects a rebound in VAP sales, driven by a strong demand for products like flavoured milk, buttermilk, curd and ice creams, which traditionally sees increased consumption during the period.

Focus on Maharashtra, expansion

A key highlight of the quarter was the announcement of Rs 280 crore capex plans for a new greenfield facility in Maharashtra, with a 10 lakh litre per day capacity, expected to start by FY27.

The expansion will be primarily funded through internal accruals, though debt options may be explored, if government incentives and favourable interest rates are available.

The plant will source milk from Solapur and nearby areas, improving distribution efficiency by tapping into Maharashtra’s milk production. This strategic move is designed to enhance presence in both southern and western India, support long-term growth, and meet the rising demand in existing and new markets.

Quick commerce and distribution channels

Currently, Dodla is available only on Zepto in Hyderabad, contributing less than 1 percent to revenue. The company is exploring key channels to expand its presence across Andhra Pradesh and Telangana. Additionally, Dodla continues to grow its network of Dodla Parlors, now at 657, with projected annual sales growth of 2-3 percent.

FY26 outlook

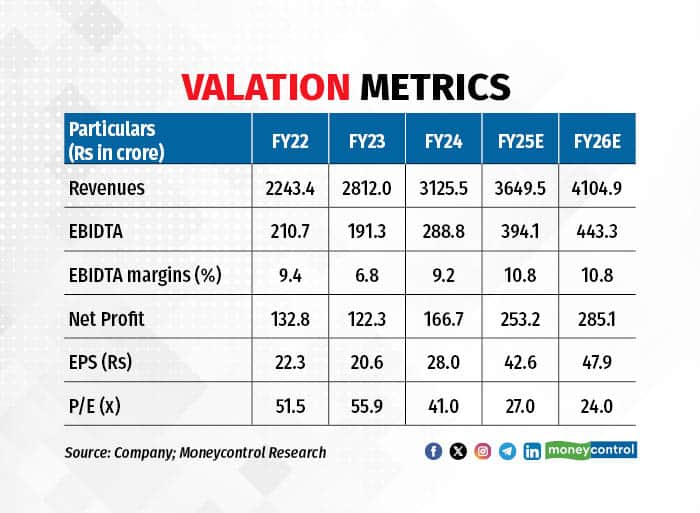

The demand scenario for dairy products remains robust, post-festive seasons, with the management indicating an uptick in consumption patterns as summer approaches. DDL has maintained its guidance for FY26, with a 10 percent volume and 15 percent revenue growth forecast. The company anticipates a steady growth in revenues and margins, supported by milk price trends. At the current market price (CMP), the stock is trading at a P/E of 23 times FY26 projected earnings. We recommend investors to add the stock.

Source : Dairynews7x7 Feb 5th 2025 Money Control by VARSHA BANG