GST Cuts may Bring Relief to Dairy Products

In a major boost for the dairy sector, the GST Council is reportedly preparing a reduction in GST rates on key household consumables—potentially extending benefits to milk, curd, paneer, and other dairy items. The proposal, announced shortly after income-tax relief to middle-class consumers, would ease the tax burden on pre-packaged dairy, currently attracting up to […]

Telangana Dairy Seeks GST Clarity on Flavoured Milk

A delegation led by K. Balakrishna Reddy of the Indian Dairy Association and Dodla Dairy petitioned Telangana’s Commercial Taxes Commissioner for clear GST guidelines on flavoured milk. Industry members report that most businesses are currently applying a 5% GST rate, treating flavoured milk as HSN 0402 (milk products) rather than as aerated beverages. This classification is supported by […]

High Court Rules Flavoured Milk as Milk, Not Beverage for GST

In a significant ruling, the Andhra Pradesh High Court has sided with Dodla Dairy Limited, determining that flavoured milk should be classified under GST Tariff Heading 0402 99 90, which attracts a 5% tax rate, rather than under Heading 2202 99 30, which carries a 12% rate. This decision overturns a previous demand by the […]

Andhra High Court lowers GST to 5% for badam milk

The Andhra Pradesh High Court recently ruled that badam ‘flavoured milk’ is not a beverage but is classifiable under a specific entry as ‘milk.’ The matter highlights a yet another classification issue under the goods and services tax (GST) regime, that reached the courts and baffled both the dairy industry and the taxpayers. Simply put, […]

Softy ice cream mix not dairy produce attracts 18% GST

Softy ice cream mix in vanilla flavour is not a dairy product and will attract 18 per cent GST, Rajasthan bench of Authority of Advance Ruling has said. VRB Consumer Products Pvt Ltd had approached the AAR on the taxability of vanilla mix in powder form which will have 61.2 per cent sugar, 34 per […]

Reduce GST on ghee to curb adulteration: IDA urges GOI

In the wake of the fake ghee making factories that are busted every year, India’s dairy sector has demanded a reduction in goods and services tax (GST) on ghee which currently attracts 12% tax. Representations from dairy sector players to the Central govt state that ironically imported palm oil, which is chemically hydrogenated, attracts just 5% […]

Packaged milk per litre: Consumers to pay Rs50 more from July 1

Pakistani packaged milk consumers will pay an additional Rs50 per litre starting July 1, 2024 due to the implementation of an 18 percent General Sales Tax (GST) in budget. The proposed 18 percent sales tax on packaged milk in the new budget could prove to be disastrous and, if not withdrawn, may shrink the size […]

Ice cream companies pin hopes on post-election GST rate cut

Ice cream companies have doubled down on their efforts to reduce GST rate by approaching the President, who has duly forwarded their representation to the Finance Ministry. Subsequently, they have key Finance Ministry officials with a plea for lowering the tax. Ice cream, sold through shops or parlours attracts 18 per cent GST. However, if […]

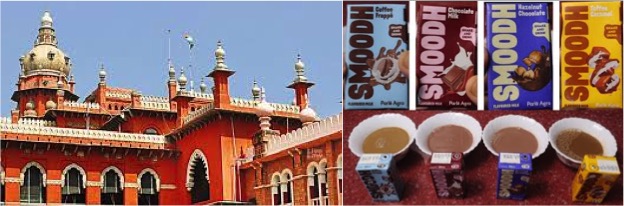

GST Council Cannot Classify Goods under GST on Flavoured Milk

While giving relief to Parle Agro on taxability of flavoured milk, the Madras High Court has held that GST Council cannot determine the classification, A single judge bench, in its recent ruling, held that flavoured milk would attract GST at the rate of 5 per cent. The GST Council, in its meeting on December 22, […]

GST Rate on Milk, Paneer & Dairy Products with HSN Code

Contrasted with different businesses, the dairy segment has coordinated branches on the drain makers in India. In spite of the fact that most recent data is demonstrative that GST (Goods and Services Tax) has been applied with 12% on all items. During the 47th GST Council meeting held in June 2022, there were some modifications recommended concerning […]