Packaged milk per litre: Consumers to pay Rs50 more from July 1

Pakistani packaged milk consumers will pay an additional Rs50 per litre starting July 1, 2024 due to the implementation of an 18 percent General Sales Tax (GST) in budget. The proposed 18 percent sales tax on packaged milk in the new budget could prove to be disastrous and, if not withdrawn, may shrink the size…

Ice cream companies pin hopes on post-election GST rate cut

Ice cream companies have doubled down on their efforts to reduce GST rate by approaching the President, who has duly forwarded their representation to the Finance Ministry. Subsequently, they have key Finance Ministry officials with a plea for lowering the tax. Ice cream, sold through shops or parlours attracts 18 per cent GST. However, if…

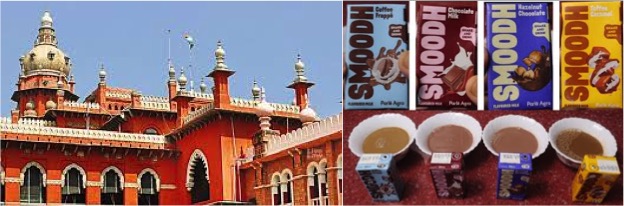

GST Council Cannot Classify Goods under GST on Flavoured Milk

While giving relief to Parle Agro on taxability of flavoured milk, the Madras High Court has held that GST Council cannot determine the classification, A single judge bench, in its recent ruling, held that flavoured milk would attract GST at the rate of 5 per cent. The GST Council, in its meeting on December 22,…

GST Rate on Milk, Paneer & Dairy Products with HSN Code

Contrasted with different businesses, the dairy segment has coordinated branches on the drain makers in India. In spite of the fact that most recent data is demonstrative that GST (Goods and Services Tax) has been applied with 12% on all items. During the 47th GST Council meeting held in June 2022, there were some modifications recommended concerning…

No plans to eliminate milk and milk products from GST net

There is no proposal to eliminate the Goods and Services Tax (GST) on milk products as the rates are based on the recommendation of the GST Council, Union Minister of State for Finance, Pankaj Chaudhary, said on Tuesday, August 1, 2023. Mr. Chaudhary said fresh milk and pasteurised milk are exempt from GST. The rates…

Government may reduce gst in ghee and butter to 5%

The government may propose reducing goods and services tax (GST) on ghee and butter to 5% from the current 12%, according to government documents reviewed by Mint. The plan comes as retail milk prices have risen by 10.1% in a year and 21.9% over the past three years due to higher feed and fodder costs…

Supply of ice cream from the outlets is not restaurant services

The Gujarat Authority for Advance Ruling (AAR) in the case of M/s HRPL Restaurants Pvt. Ltd. Vide Advance Ruling No. GUJ/GAAR/R/2023/08 dated 22.02.2023 Ltd. has ruled that the supply of ice cream from the outlets cannot be classified as the supply of ‘restaurant services’, leviable to GST 18%. In this case, the applicant is engaged in the restaurant business…

Do away with different rate of GST on SMP, ghee: Chandramogan

R.G. Chandramogan, Chairman, Hatsun Agro Products, has urged the government to do way with the practice of charging different rates of GST on milk fats and skimmed milk powder (SMP), both of which are milk products. Milk is separated into two parts – SMP (skimmed milk powder) and milk fat. While milk fat is taxed…

India GST: The ‘cheesy’ row over pizza toppings tax in India

It can be a challenge to get the right mix of toppings that makes a pizza delicious. An overload of toppings could make the dough soggy and a wrong mix can affect the flavour. But in August, an Indian firm making pizza toppings mounted a different challenge in a court. It was not about the…

Flavoured milk is not milk but a drink containing milk. So pay 12% GST

As per the GST rules, there is no GST on fresh milk, pasteurised milk, curd and lassi. But if you buy flavoured milk, you pay GST of 12%. This is because flavoured milk ”is not milk” but a beverage in which milk is a component. You may have been counting your blessings all these years since…