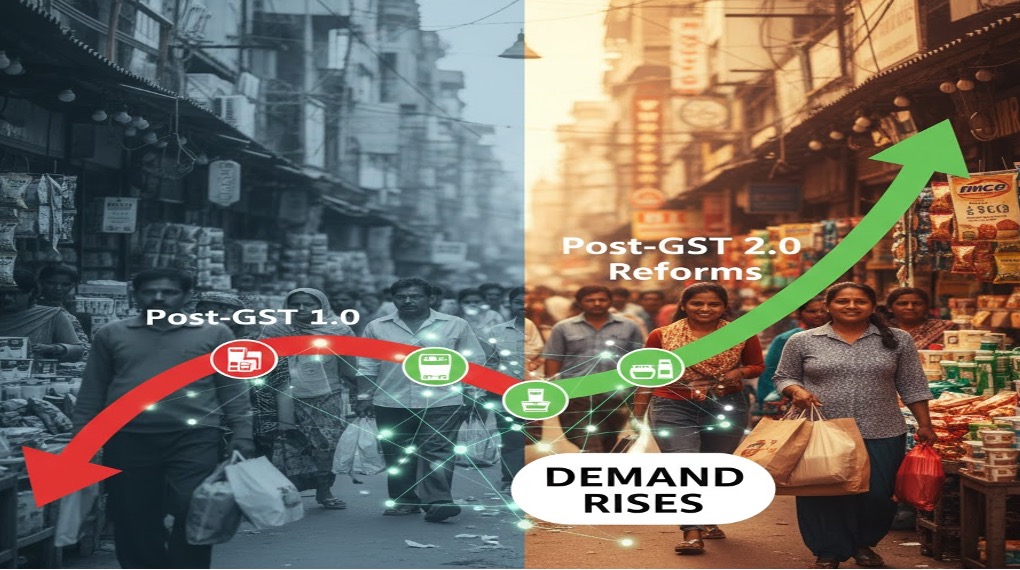

FMCG Engine Stabilises Post-GST 2.0; Demand Set to Rebound

India’s fast-moving consumer goods (FMCG) sector is showing clear signs of recovery after initial disruptions caused by the rollout of GST 2.0, with companies reporting stabilisation of operations and preparing for renewed demand growth in the coming quarters. Following the GST structure revision, the FMCG industry faced a transitional slowdown as supply chains, inventory strategies,…

Milky Mist passes GST benefits to consumers

Milky Mist Dairy Food Limited (“Milky Mist”) announced a revision in its prices of its products to pass on the benefits of recent Goods and Services Tax (GST) rate revisions to consumers while ensuring that farmers receive direct support through increased milk procurement prices. Following the latest GST revisions, Milky Mist has reduced the Maximum…

GST Rationalization Boosts Dairy Sector; Most Products at nil or 5%

In a landmark move to strengthen India’s dairy sector, the 56th GST Council, in its meeting held on 3rd September 2025 approved sweeping tax rationalizations on milk and milk products. These reforms mark one of the most comprehensive overhauls of GST rates in the sector, ensuring that most dairy products are now either exempt from tax…

GST on Ghee: Aligning Policy with Ground Realities

GST on Ghee: A Trader-Friendly Approach Can Bridge Policy and Market Realities The Government of India is actively considering reducing GST on consumer goods including ghee from 12% to 5%, a move that has the potential to bring relief to households and boost demand for one of the most widely consumed dairy products in the…

GST Cuts may Bring Relief to Dairy Products

In a major boost for the dairy sector, the GST Council is reportedly preparing a reduction in GST rates on key household consumables—potentially extending benefits to milk, curd, paneer, and other dairy items. The proposal, announced shortly after income-tax relief to middle-class consumers, would ease the tax burden on pre-packaged dairy, currently attracting up to…

Telangana Dairy Seeks GST Clarity on Flavoured Milk

A delegation led by K. Balakrishna Reddy of the Indian Dairy Association and Dodla Dairy petitioned Telangana’s Commercial Taxes Commissioner for clear GST guidelines on flavoured milk. Industry members report that most businesses are currently applying a 5% GST rate, treating flavoured milk as HSN 0402 (milk products) rather than as aerated beverages. This classification is supported by…

High Court Rules Flavoured Milk as Milk, Not Beverage for GST

In a significant ruling, the Andhra Pradesh High Court has sided with Dodla Dairy Limited, determining that flavoured milk should be classified under GST Tariff Heading 0402 99 90, which attracts a 5% tax rate, rather than under Heading 2202 99 30, which carries a 12% rate. This decision overturns a previous demand by the…

Andhra High Court lowers GST to 5% for badam milk

The Andhra Pradesh High Court recently ruled that badam ‘flavoured milk’ is not a beverage but is classifiable under a specific entry as ‘milk.’ The matter highlights a yet another classification issue under the goods and services tax (GST) regime, that reached the courts and baffled both the dairy industry and the taxpayers. Simply put,…

Softy ice cream mix not dairy produce attracts 18% GST

Softy ice cream mix in vanilla flavour is not a dairy product and will attract 18 per cent GST, Rajasthan bench of Authority of Advance Ruling has said. VRB Consumer Products Pvt Ltd had approached the AAR on the taxability of vanilla mix in powder form which will have 61.2 per cent sugar, 34 per…

Reduce GST on ghee to curb adulteration: IDA urges GOI

In the wake of the fake ghee making factories that are busted every year, India’s dairy sector has demanded a reduction in goods and services tax (GST) on ghee which currently attracts 12% tax. Representations from dairy sector players to the Central govt state that ironically imported palm oil, which is chemically hydrogenated, attracts just 5%…