The FAIRR Initiative’s global collaborative investor engagement on sustainable protein is the first to encourage the world’s largest food companies to develop a global, evidence-based approach to diversify protein sources away from an over-reliance on animal proteins.

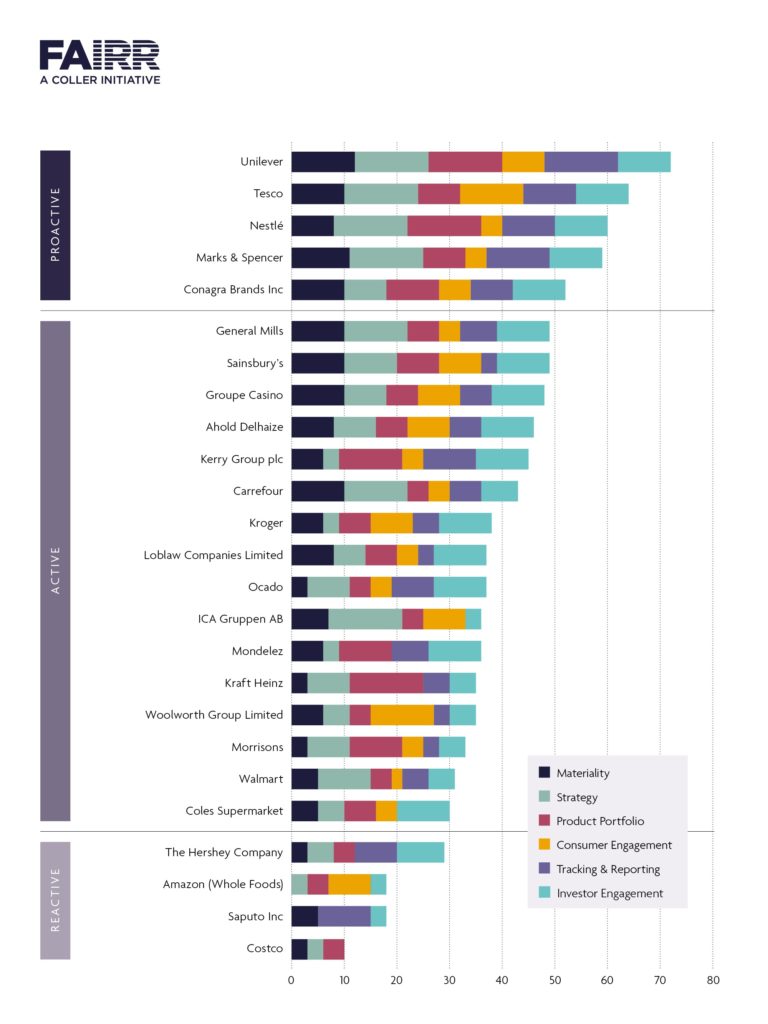

The engagement asks 25 global food companies to diversify their protein sources to drive growth, increase profitability, reduce risk exposure, and improve their ability to compete and innovate in a resource-constrained world.

Phase 5 of the engagement was supported by 104 investors representing over $17.7 trillion in combined assets.

Alternative proteins are now big business and driving growth in the food sector. For investors, an expanding alternative protein portfolio is a lever for growth. More importantly, it is a fundamental and necessary component to manage a company’s exposure to the most material ESG risk facing the food sector. A sole focus on supply chains, which is isolated from portfolio composition, will result in greater capital investment to address risks as demand for meat, dairy and fish continues to grow.

Companies must complement their supply chain interventions with a systematic transition to ensure their protein portfolio results in better health outcomes and is in line with planetary boundaries.

What is protein diversification?

A protein diversification strategy cannot merely focus on adding a few alternative protein products to a company’s current portfolio. It requires companies to develop a comprehensive strategy to expand product development and research, explore the applicability of new food technologies and acquisitions, leverage their marketing power to influence consumers to embrace new products, and engage their supplier community to mitigate impacts on farmer livelihoods. To undertake such a transformation, companies must:

- Evaluate their current exposure to animal proteins (meat, poultry, dairy, egg, fish and seafood) and the risk profile of these supply chains

- Assess the strategic implications of growth plans that are predicated on a higher reliance on animal proteins (through scenario analysis).

- Commit at the highest level to transitioning their global business model to less resource-intensive ingredients and products

- Develop a cross-functional strategy (involving R&D, marketing, sustainable sourcing) to undertake a transition

- Set clear goals and timelines to support a clear pathway for action

- Report on the right metrics to evaluate and measure progress and impacts