Progressive dairy farmers across India are questioning the government’s intent behind keeping essential technologies like bulk milk coolers and milking machines under the 18% GST slab. They ask: is the government not confident of their capability to adopt modern practices that ensure hygienic milk production and higher yields?

Farmers argue that calling this a “farmer-friendly budget” is hollow when the basic tools required for clean milk production are heavily taxed, and no input tax credit (ITC) is available on other crucial farm implements such as vaccines, semen feed additives, and sanitation chemicals, other services as per the following table .

Pevailing GST on dairy farm

| SR.No | Description of Goods/Services | HSN/SAC (Code 6-8 Digit) | Present Rate |

| 1 | Veterinary Medicine | 330499, 300490 | 12% & 18% |

| 2 | Vaccine | 300431 | 5% |

| 3 | Milking Equipments | 908447 | 18% |

| 4 | Consumable Items for cleaning and sanitization | 282890,731021,281511 | 18% |

| 5 | Farm Implements and Services | 841989,870192 | 18% |

| 6 | Repair & Maintenance | 998729, 998719 | 18% |

It looks nothing has changed except for the item shown under 12% gst. By making technology adoption prohibitively expensive, the government risks stalling the progress of over 80 million dairy households who are eager to produce more and better-quality milk for India and the world. While sharing the above details Deepak Raj, (Founder Binsar Farms Delhi-NCR) told me that I have also raised voices in many forums … Even farmers are also not aware of this indirect expense to their pockets which they can’t claim back like other industries.

On one side, govt claim to increase the income of farmers but they completely forgot that all farmers are paying this tax to these companies added Deepak Raj.

On other hand Sukhjeet Singh Kahlon, Director and CEO @ Intracare India , the current tax regime on dairy implements is as below:

Semen- 05119991-Zero

Feed- 23099090- Zero

Silage- 23099090-Zero

Milking Machine- 8414- 18%

Automation- 85176290- 18%

Ear Tags- 90318000- 18%

Medicine- 30049085- 12%

Dermal Spray- 33049085- 18%

Water Disinfectant- 2847000-18%

Vaccine(V) – 30024200- 5%

Vaccine(B) – 30023000-5%

Cleaners/ Detergents – 34029099- 18%

Disinfectant- 380890999- 18%

This list underscores and validates the heavy cost burden now placed on dairy farmers under the GST 2.0 reforms. These capex items are not optional luxuries but the very backbone of clean and hygienic milk production. The situation demands urgent and focused attention from policymakers.

India’s dairy sector is at a crossroads. While recent GST 2.0 reforms brought welcome relief on several farm inputs—cutting GST on solar pumps, biogas plants, Milk cans and key dairy products—the government’s continued indifference toward dairy-farm machinery remains a glaring oversight. Milking machines, bulk milk coolers, and other essential equipment still attract an onerous 18 % GST since 2022, up from the earlier 12 % slab.

This is very important because these capital expenditure (capex) items — such as equipment, machinery, or infrastructure — form the essential foundation that makes clean and hygienic milk production possible. Without affordable access to such machinery, farmers risk delivering poor-quality milk to both domestic processors and export markets.

Milking Machines

Modern milking machines are equally vital for producing hygienic, export-ready milk. Research in Europe and India has shown that mechanised milking reduces microbial contamination by minimising direct human contact and ensuring more consistent teat preparation. Studies on robotic and automated milking systems reveal that when equipment is properly maintained and operated under correct vacuum levels and liner hygiene, they lower somatic cell counts (SCC) and improve udder health outcomes.

Conversely, neglecting cleaning protocols or delaying equipment maintenance can increase bacterial counts, underlining the need for training and service support alongside adoption. In the Indian context, where GST on milking machines was shockingly raised from 12% to 18% in 2022, this policy disincentivize works against the national goal of producing cleaner milk. All items for cleaning, sanitation, cleaning services, hoof trimming services, etc are again getting taxed under 18% which adds to the burden to the farmers. Research-backed evidence makes it clear: wider adoption of mechanised milking leads to measurable improvements in milk quality, animal welfare, and farmer income — and therefore deserves tax relief, not penalisation.

Neeraj Kumar, Managing Director Delaval India further added that “Farm Mechanization like milking, feeding, bulk milk cooler , manure scrapper etc. are vital for dairy farmers, just as it is for agricultural producers using tractors and harvesters. Despite this, a disparity in tax treatment persists: In the latest GST reforms While agriculture machinery benefits from a reduced GST of 5%, dairy farm machinery and parts continues to attract 18% GST. This discourages mechanisation in dairy farming sector and creates economic strain for dairy farmers striving to invest in milk production for future.

Sudden hike in GST from 12% to 18% in milking machinery in 2022

Industry stakeholders were stunned when milking machinery tax leapt from 12 % to 18 % mid-term. As reported by Milma and the Indian Dairy Association in , this abrupt hike in 2022 caught cooperatives off guard, threatening livelihoods and undermining efforts toward formal, quality-controlled dairy.

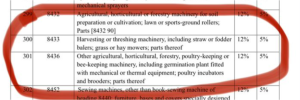

As per Sandeep Raina Managing Director Vansun Technology, another leading manufacturer of dairy farming equipment and milking machineries told me that Dairy equipment’s and milking machine which comes in 8434 category have been bypassed in the current GST 2.0 reforms. Though there has been some visible relaxation for straw and fodder handling equipment under 8432 shown as below from 12-5%, the clarity on same reduction from 12-5% for TMR machines is yet to be ascertained.

Cooling milk instantly after milking is the hallmark of milk quality for any country. Rapid cooling at the farm level is universally recognised as the cornerstone of clean milk production. Studies show that milk cooled to 3–4 °C within hours of milking exhibits significantly lower bacterial growth and retains its compositional quality even during extended storage and transport. Evidence from Indian dairy projects under RKVY demonstrates that installing Bulk Milk Coolers (BMCs) at village collection points directly reduces spoilage, improves microbial safety, and enhances shelf life, making milk more competitive for domestic and export markets.

One case study reported that procurement volumes and farmer incomes rose sharply within months of BMC commissioning, as cooperatives could collect more milk and pay better prices due to reduced losses. International research echoes these findings, confirming that rapid on-farm cooling not only curbs psychrotrophic bacteria but also extends usable storage time, ensuring compliance with global standards.

Still Keeping 18% gst on these milk cooling tanks whereas milk cans reduced from 12% to 5% doesn’t sound logical from any angle told Sumeet Kakkar, Director- Commercial of Serap India Private Limited ( Serap Group, France)

On top of that, many other critical inputs remain taxed or unchanged under the reforms. Vaccines and veterinary medicines—critical for herd health—still face variable GST (typically 5 % or more), while feed additives, cleaning and sanitization chemicals, milk cans, and even some veterinary services continue to carry GST burdens. These not only raise operating costs but also impact the ability of smallholders to invest in better practices, eroding margins and undermining food safety and export potential.

The cost of doing nothing during GST 2.0 reforms is clear. Firstly, higher GST on machinery delays adoption of quality-enhancing infrastructure, leading to inferior milk quality. That, in turn, dents India’s competitiveness in dairy exports, threatens rural incomes dependent on safe milk, and furthers inequality across the dairy ecosystem.

The government must now act decisively. It should restore the concessional 5 % or even zero rating for milking machinery, bulk milk coolers, and allied equipment to safeguard India’s dairy quality standards and the livelihoods of its 80 million dairy-farming households.

Source : Blog by Kuldeep Sharma Chief Editor Dairynews7x7 Sep 5th 2025